UM vs UIM Insurance Coverage: What You Need to Know

Follow us on

social media!

UM vs UIM Insurance Coverage: What You Need to Know

Cyclists and motorists alike face numerous risks on the roads, and one of the most significant concerns is the presence of uninsured motorists. We all know the importance of strapping on a helmet to protect your head in the event of a bicycle crash. But what about financial protection if an uninsured or underinsured driver causes damages to you and your property?

That's where Uninsured Motorist (UM) and Underinsured Motorist (UIM) coverages come into play. You might wonder, "What are UM and UIM, and why do they matter to me as a cyclist?"

Simply put, UM coverage offers you a potential safety net if you're hit by a driver without insurance, while UIM provides additional protection if the driver's insurance doesn't fully cover your damages. It doesn't matter if you are on your bike or behind the wheel of a car, adding UM insurance to your auto policy is a wise decision.

Besides wearing a helmet, the #1 Piece of Advice Bike Legal suggests for ALL cyclists (and motorists), is to make sure you have good UM/UIM Insurance.

In this article, we'll cover:

- What UM and UIM insurance coverage entail

- The critical differences between UM and UIM

- How each type of liability coverage protects you in case of an auto accident

- Factors to consider when choosing between UM and UIM

- Real-life case studies illustrating the importance of UM and UIM coverage

UM vs UIM Insurance Coverage

Uninsured Motorist (UM) and Underinsured Motorist (UIM) insurance coverage are crucial for protecting yourself against damages from accidents with drivers who lack sufficient insurance.

While uninsured motorists ' coverage addresses costs from an uninsured driver, UIM coverage fills the gap when the at-fault driver's insurance is inadequate. Understanding the nuances between the two can safeguard you financially in many scenarios, but details like coverage limits and state requirements can further influence their effectiveness.

Watch this informative video provided by Phil Gaimon, retired pro cyclist.

How UM & UIM Works in Different Scenarios

Coverage Purpose & Scenario

- UM (Uninsured Motorist Coverage): Provides protection when you're involved in an accident caused by a driver who either lacks auto insurance or cannot be identified (e.g., hit and run). For instance, if an uninsured driver runs a red light, causing injury to you and damage to your bicycle, UM coverage would cover your medical and other injury related expenses, but typically not the damage to your bicycle.

- UIM (Underinsured Motorist Coverage): Comes into play when the at-fault driver's insurance is insufficient to cover all your damages. For example, if your total damages from an accident are $100,000, but the at-fault driver's policy only covers $75,000, your UIM coverage would potentially cover the remaining $25,000, up to the limits of your policy.

Policy Limits

- UM: The coverage limit is determined by your policy's maximum. It will only pay up to your UM limit for damages caused by an uninsured driver. For example, if you have a UM policy limit of $100,000, and you sustain $100,000 in damages from an accident with an uninsured driver, your policy could cover the full amount, subject to the terms of your insurance.

- UIM: The coverage limit fills the gap between the at-fault driver's insurance payout and your actual damages, without exceeding your own UIM policy limit. Using the previous example, if you have $100,000 in UIM coverage and the at-fault driver's insurance pays $50,000 out of your $100,000 in damages, your UIM policy could cover up to an additional $50,000, ensuring you're not left covering the cost difference out of pocket.

In some states, your auto insurance company is required by law to automatically make UM/UIM coverage available to you with the same limits as your bodily injury liability coverage.

Availability and Requirements

- UM: Mandatory in some states, this coverage ensures that drivers have some form of protection against uninsured drivers. The requirement for UM coverage highlights its importance in providing a safety net in regions with higher rates of uninsured motorists.

- UIM: Not always required and may be optional in certain states. Its availability and encouragement to purchase it reflect the reality that many drivers carry the minimum liability insurance, which may not be enough to cover damages in more serious accidents.

Scope of Coverage

- UM: Typically covers both bodily injury (UMBI) and, in some states, property damage (UMPD) caused by an uninsured driver. UMBI pays for medical expenses, lost wages, and pain and suffering, while UMPD covers vehicle repair or replacement costs, it typically does NOT cover the damage to your bicycle.

- UIM: Primarily focuses on bodily injury in many states (UIMBI), with property damage coverage (UIMPD) being less commonly offered or required. UIMBI helps cover the gap between your injury expenses and the limits of the at-fault driver's liability coverage, but UIMPD, where available, functions similarly for vehicle damage and does not cover any damage to your bicycle.

Claim Process

- UM: The claim process may involve proving the other driver was at fault and uninsured. This might include police reports indicating a hit-and-run incident or documentation from the other driver's insurance company confirming a lack of coverage.

- UIM: Requires submitting evidence of the extent of your damages and the at-fault driver's insurance limits. Underinsured motorists need to demonstrate that your damages exceed the coverage provided by the at-fault driver's insurance, necessitating a claim under your UIM policy.

Premium Impact:

- UM: Adding or increasing UM coverage can affect your premium, but given the protection it offers against uninsured drivers, many find the cost reasonable. The impact on premiums varies by state and insurer.

- UIM: Similarly, opting for or enhancing UIM coverage will influence your insurance premium. However, considering the potential out-of-pocket expenses it can save you in the event of an accident with an underinsured driver, it's often considered a valuable investment.

The Pros & Limitations of UM and UIM Coverage

Navigating auto insurance options reveals Uninsured (UM) and Underinsured Motorist (UIM) coverages as essential for protection against inadequately insured drivers. While offering crucial financial security, these coverages also carry limitations. Weighing their pros and cons is vital for tailoring your policy to meet your specific needs.

Pros of UM Coverage:

- Financial Protection: Offers a safety net against losses from accidents with uninsured drivers, covering medical bills, lost wages, and, in some cases, property damage.

- Legal Support: This may provide legal representation if you sue an uninsured driver, helping to recover costs not covered by insurance.

- Peace of Mind: Knowing you're protected in an accident with an uninsured driver can alleviate stress, especially in areas with high rates of uninsured motorists.

Cons of UM Coverage:

- Cost: Increases your auto insurance premium. While generally affordable, the cost can add up, especially if you choose higher coverage limits. A nationwide study found that, on average, the TOP FIVE insurance companies raise premiums by 9.32% after a no-fault accident resulting in an uninsured motorist claim, but in some states, such as California and Oklahoma, insurance companies only raise premiums after an at-fault accident and not for a no-fault claim.

- Coverage Limits: The protection is up to the limits you purchase. If your damages exceed these limits, you'll have to cover the difference.

- Not Always Required: Not mandatory in all states, leading some drivers to skip this coverage, potentially leaving them vulnerable.

Pros of UIM Coverage:

- Gap Coverage: Bridges the financial gap when the at-fault driver's insurance is insufficient to cover your total damages, ensuring you're not left with out-of-pocket expenses.

- Comprehensive Protection: Enhances your overall protection on the road, especially useful in serious accidents where the at-fault driver's liability limits are quickly exceeded.

- Adaptability: This can be tailored to your needs and risks, allowing for higher limits for greater coverage, depending on your driving habits and the area you live in.

Cons of UIM Coverage:

- Underutilization: The circumstances under which UIM coverage is applicable are less common, potentially leading to paying for coverage that is rarely used.

- Complex Claims Process: Filing a UIM claim can be complicated, requiring proof that the at-fault driver's insurance is inadequate and that your damages exceed their coverage limits.

- Overlap with Other Coverage: Some of your damages might already be covered under other parts of your auto insurance policy, like medical payments coverage, potentially diminishing the unique value of UIM.

Choosing Between UM & UIM Coverage - What's best for you?

Choosing between Uninsured Motorist (UM) and Underinsured Motorist (UIM) coverage—or deciding to opt for both—depends on an individual's specific needs, driving and cycling habits, and the level of risk they are willing to accept. Here are some considerations to help determine the best choice:

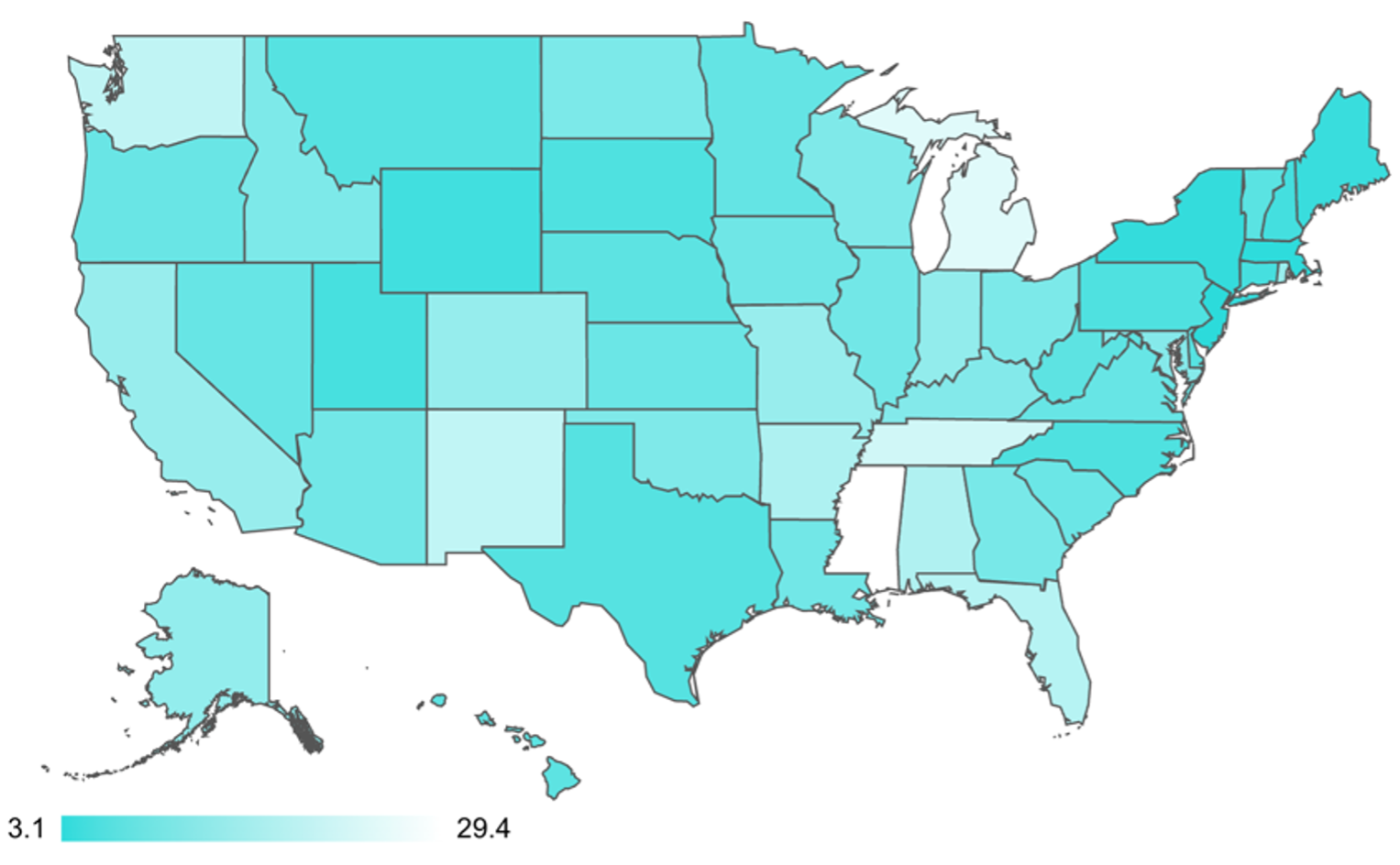

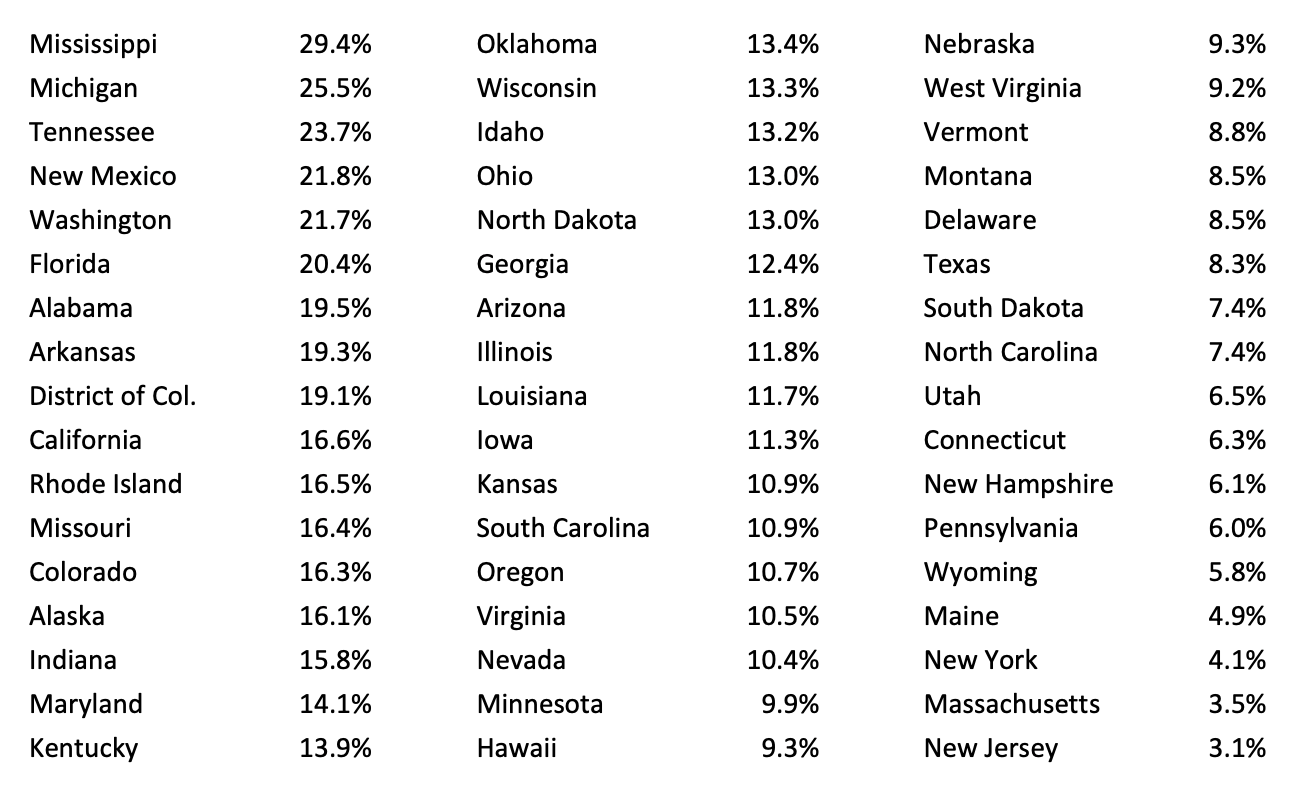

Geographic Location

- High Rate of Uninsured Drivers: If you live in an area with a high percentage of uninsured drivers, UM coverage becomes more valuable. It ensures protection against potential accidents where the other party lacks insurance.

- Check Reports: Look for the Insurance Research Council (IRC) or your state insurance department's website for statistics on uninsured drivers by state.

- Contact Your Insurance Agent: Speak with local auto insurance agents who may have access to relevant data or insights on uninsured motorist rates in your area.

- Research Online: Search for recent studies or news articles online that discuss uninsured driver rates in your region.

- Socioeconomic Factors: In regions with lower socioeconomic status, drivers might opt for minimal insurance coverage, making UIM coverage more relevant to cover the gap between their limited liability and your actual damages.

Personal Financial Situation

- Ability to Absorb Costs: If you have significant savings or an emergency fund, you might feel more comfortable taking the risk of not having UM or UIM coverage. However, for most, the potential financial burden of an accident with an uninsured or underinsured driver can be mitigated by opting for one or both coverages.

- Risk Tolerance: Assess your tolerance for potential financial loss. If the thought of unexpected out-of-pocket expenses is unsettling, securing both UM and UIM coverage could provide peace of mind.

- Bike Legal Recommends $250k in UM/UIM Insurance. Contact your auto insurance agent for a quote so you can decide what you can afford for added peace of mind.

Driving or Cycling Frequency and Distance

- Frequent Commuters: If you're on the road often or commute long distances, the likelihood of encountering an uninsured or underinsured driver increases. In such cases, having both UM and UIM coverage offers broader protection.

- Infrequent Drivers or Road Cyclists: Less time on the road might reduce your risk exposure, but accidents can happen at any time. Evaluate whether the reduced risk justifies forgoing either coverage.

Legal Requirements and Recommendations

- State Laws: Some states require UM coverage, and a few might also require UIM coverage. Be aware of your state's laws to ensure compliance while also considering additional coverage for optimal protection.

- Insurance Advisors: Consult with an insurance professional or financial advisor who can provide personalized advice based on your circumstances and the specific risks in your area.

All in all, choosing UM and UIM coverage depends on local uninsured rates, your financial resilience, and driving and cycling habits. In areas with many uninsured drivers, UM is essential and UIM is crucial for gaps in coverage. Assess your risk and consult professionals to decide, ensuring you're protected against unforeseen accidents efficiently.

Protect Your Ride with Bike Legal: Navigating UM and UIM Coverage

In wrapping up our discussion on the crucial choices between Uninsured Motorist (UM) and Underinsured Motorist (UIM) coverage for cyclists, here are the key takeaways to remember:

- Understand Local Uninsured Rates: Knowledge of the uninsured motorist rates in your area can significantly influence your decision on UM and UIM coverage.

- Evaluate Your Financial Situation: Assess your ability to handle potential out-of-pocket expenses after an accident with an uninsured or underinsured driver.

- Consider Your Cycling Habits: Frequent riders and those in high-risk areas may benefit more from comprehensive UM and UIM coverage.

- Be Aware of State Laws: Legal requirements for UM and UIM coverage vary by state. Ensure you're compliant and adequately protected according to your local regulations.

For cyclists, an encounter with an uninsured or underinsured motorist can lead to complex legal and financial challenges. Securing the right coverage is a proactive step toward your safety and peace of mind on the road.

If you find yourself navigating the aftermath of a bicycle accident, Bike Legal specializes in representing cyclists, offering expert legal advice and support to help you claim the compensation you deserve.

Request a free consultation by calling 877-BIKE LEGAL (877 245-3534) or submitting a form. Stay informed, stay protected, and let Bike Legal back you up every pedal of the way.